· The Consumer Duty will help the UK financial services industry to offer the best service to its customers.

· It comes into force from 31 July 2023 for existing products and services.

· The Financial Conduct Authority (FCA) will take swift action where it finds evidence of harm or ‘risk of harm’ to consumers.

As consumers, when we buy insurance, take out a mortgage, borrow credit or invest, we want to know that the business we are dealing with is recommending and providing the right product for our needs. Building a foundation of trust is vital to anyone operating in the financial sector, and it’s even more critical when dealing with people who may be feeling the pinch from the current cost of living squeeze or for those who are vulnerable and facing short or long-term debt.

The Financial Conduct Authority’s (FCA) Consumer Duty seeks to ensure customers receive ‘good outcomes’ and that firms provide evidence that these outcomes are being met.

How does the FCA define a good outcome?

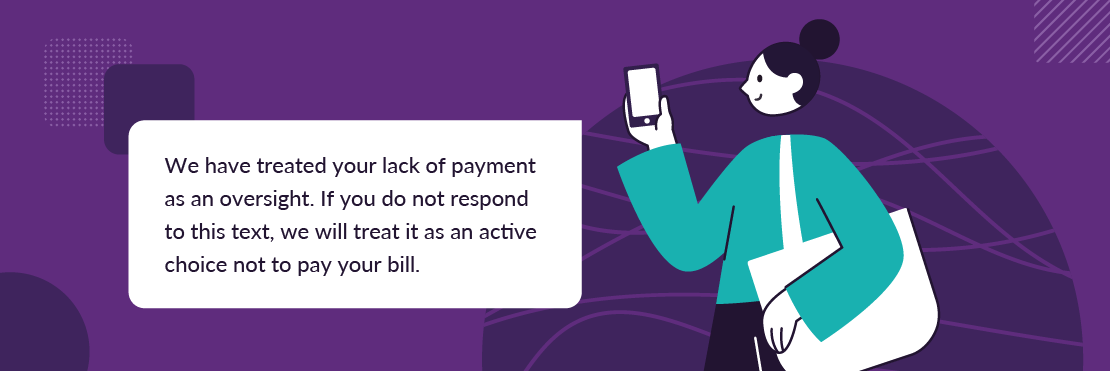

Put simply, firms should provide customers with products and services that meet their needs and offer fair value. Customers should receive communication that they understand and should also be able to access customer support when they need it.

How do financial firms prove good outcomes?

Firms need to provide evidence that their products consistently deliver good outcomes which may include demonstrating:

· how suitable products and services are for customers

· how clear products, terms and conditions are to enable customers to make an informed decision

· how varying customer needs are met, including any in vulnerable circumstances, and how this is maintained in every interaction (for example, through proportionate and appropriate forbearance and enforcement policies)

· how helpful customer support is and how easy it is to access.

We’re here to help

At Esendex, we’ve been working with customers in the financial sector for over 20 years and understand what it takes to design award-winning and secure customer communication and mobile collection and payment journeys that puts customers at the heart of every touchpoint and transaction.

Chris Gorman, Head of Professional Services, explains “Looking at customer behaviour over time can be a really useful lens, for example: the length of time spent before repaying debt and the appetite to self-manage, or the need for ongoing customer support or access to third-party support organisations.”

If you’re serious about embedding the Consumer Duty, as a financial firm, local government authority, debt collector, debt purchaser or housing association then designing a mobile journey that is efficient, ethical and easy to implement might just be the best decision you could make. Click here to read our guide to learn even more.

“The mobile-focused approach we’ve adopted in partnership with Esendex has really been a revelation for us. We’ve seen a big uptick in our arrangement and collection numbers, but more importantly, we’re also providing better services and tools to our customers.”

GARETH HALL – SENIOR COLLECTIONS MANAGER, DEBT MANAGERS

Additional Resources: