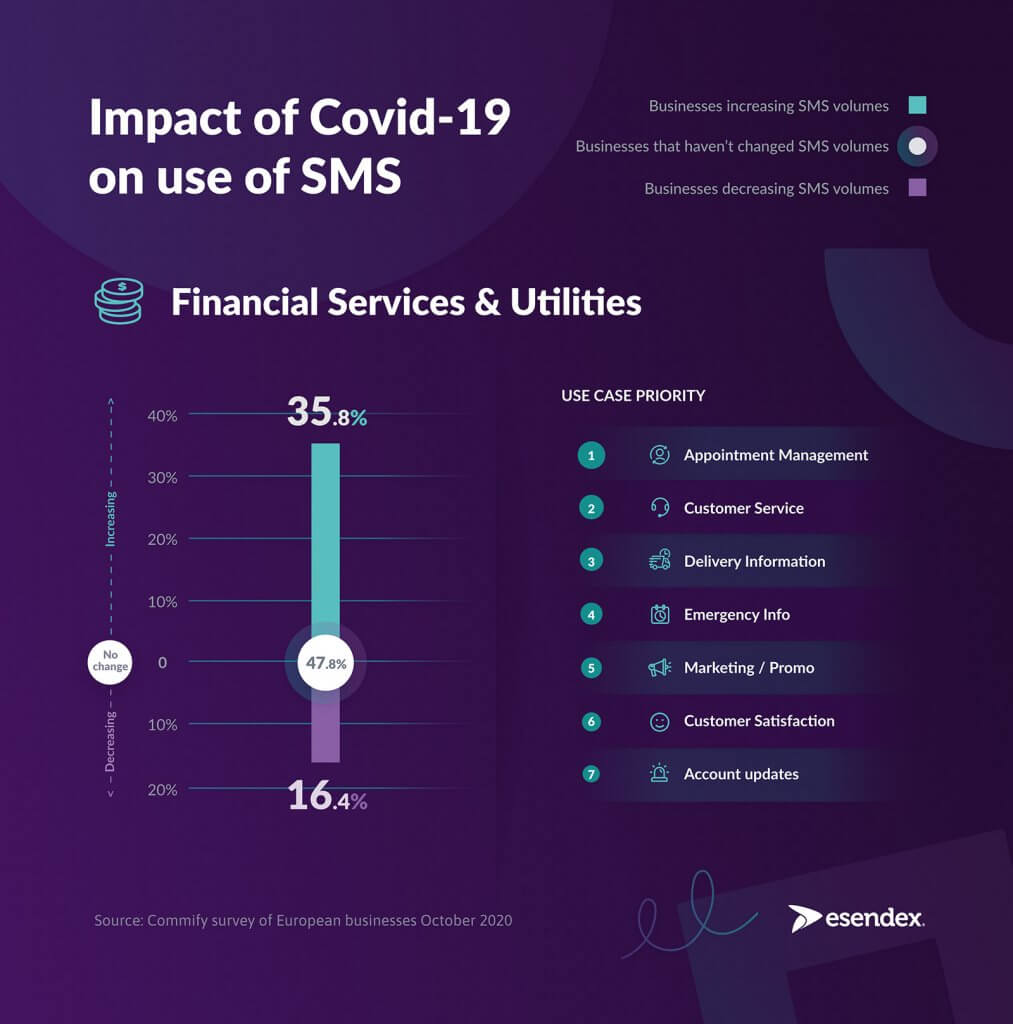

When compared with pre-pandemic levels, 35.8% of finance and utility companies confirmed they were sending more business messages.

As the UK enters what is predicted to be the worst recession for 300 years, it’s fair to say that 2020 has presented a number of challenges for individuals, businesses and organisations alike.

Arguably however, the coronavirus pandemic has affected the finance and utility sector, in a relatively unique way. In addition to having to adapt to existing processes and enabling more digital, self-serve capabilities for clients, firms have also had a responsibility to provide adequate support and leniency towards customers. This has been echoed by the regulator throughout the pandemic, and has materialised in the implementation of things like payment holidays, credit extensions and even temporary bans on contacting customers regarding unpaid bills.

Clearly for businesses to effectively operate under these circumstances, customer communication and engagement has been paramount. So much so in fact, that our latest research found that over one third of finance and utility companies had increased their business messaging during Covid-19.

When compared with pre-pandemic levels, 35.8% of finance and utility companies confirmed they were sending more business messages to potential and existing customers and almost half (47.8%) said they were sending roughly the same amount. Finally, the survey revealed that just 16.4% had reduced the number of messages they sent when compared to pre Covid-19 times.

The detail of this increase, split by business activity, can be found below:

- Account updates – 17.95%

- Customer service/process updates – 17.95%

- Delivery information – 17.95%

- Appointment management – 15.38%

- Marketing/promotional activity – 12.28%

- Customer satisfaction surveys – 10.26%

- Emergency information – 7.69%

The data forms part of a wider research project which surveyed over 600 international companies on how Covid-19 has impacted their business communications. Overall, 38% of companies surveyed reported that they’re business messaging had increased when compared to pre-pandemic numbers, and just 13% said they were sending fewer messages.

Given the amount of uncertainty regarding recovery and the fact that the total number of unemployed people in the UK has sadly risen to 1.62 million, finance and utility firms have a challenging task ahead ensuring they continue to support their customers, while successfully navigating these challenging times.

With this in mind, we have outlined three trends we predict will continue to gain momentum into 2021 and form an important role in finance and utility recovery.

Customer-centric debt recovery strategies

With the pandemic plunging one in three consumers into debt, and Paragon Bank’s research reporting that the pandemic has had a devastating effect on people’s mental wellbeing, with money worries being a significant contributor, firms will be required to continue going beyond ethical debt collection.

Treating customers fairly will always remain a top priority for those in the financial services and utility sector, and as a large part of that is ensuring customer circumstances are sufficiently understood, this is arguably more important than ever before.

We expect firms will continue to implement debt recovery strategies which are more personalised and sensitive to the customer, offering longer term plans in a bid to make customer repayments more affordable.

Continued rise in business messaging

Keeping customers engaged throughout the debt recovery process can be a challenge, but without this companies risk getting no payment at all. With face-to-face interactions reduced for the foreseeable future, companies have had to introduce more effective ways to communicate with their customers and keep them engaged. As our research has shown, business messaging has already increased for over a third of firms, and we expect this figure will continue to rise in 2021.

Moreover, given that just 45% of UK households have a landline, compared to 84% having a mobile phone, and the indebted population actually rely more heavily upon mobile, we expect business messaging will continue to be created mobile first.

The future of contact centres

During the pandemic, there has been a 44% increase in call volume within the UK. In order to manage this influx, while also addressing the various operational challenges which have come as a result of lockdown restrictions and reduced staffing, many companies have turned to technology to enhance their customer service offering. According to Gartner research, organisations report a reduction of up to 70% in call, chat and email enquiries after implementing a Virtual Customer Assistant (VCA). Given the results we have seen with our clients who have implemented an Esendex VCA, we expect that next year, companies will continue to invest in these types of customer service technologies. Afterall, they are capable of improving business efficiencies while also enhancing the customer experience.

As mentioned above none of these trends are new, they have all simply been exacerbated in the current climate. As the situation regarding the pandemic remains uncertain and ongoing, it is the firms that continue to adapt, that place themselves best to support their clients. So, to firms already seeing the benefits of these approaches and technologies, it’s paramount these efforts continue.

If you’d like to get started with a more effective messaging strategy, please get in touch with our team on 0345 356 5758, or email [email protected] where we’ll direct you to one of our expert team for your industry and requirement.