Many businesses are still wasting resource by chasing payments through letters and manual phone calls. But there is a better way. Mobile Payments offers a digital solution which provides higher engagement, reduced costs, and more payments collected.

Did you know that 46% of consumers now actively prefer using their mobile devices for the entirety of a payment process? (Source) How about that in the last 6 months alone 62% of smartphone users have made a payment using their mobile devices? (Source)

With these stats in mind it’s become clear that in any industry, if businesses want to be as successful as possible, an effective strategy for collecting payments via mobile devices is absolutely critical. However many industries are still reliant on chasing payment in the old way fashioned ways.

So what’s the problem with using traditional channels to collect payments?

Traditional ways of chasing payments (like making agent-based phone calls and sending paper letters) which many are still using, are much less engaging than their modern digital equivalents. Postal payment reminders, for instance, have a 75% open rate, compared with 95% for SMS (Source). Couple this with the fact that an amazing 86% of calls from businesses get ignored by customers (Source) and you can start to build a clearer picture as to why the amounts owed to businesses are continuing to rise.

Traditional channels are also much more expensive to deploy compared to their modern counterparts. A campaign sent to 1000 customers through post would cost around £500, have a response rate of 2.5% giving us a cost per response of £20. This will often be more than the amount of debt actually owed, so in some cases the debt would be written off.

We can also look to agent-based calls as an area to make savings. In a study conducted by Esendex we found that the average cost for a collections agent to take a payment from a customer was £1.25 (based on a cost per hour of £15, and a 5 minute call time). Compare this with a modern, self-serve telephone payment line cost of 67.5p per payment (7.5p cost of call, and 60p transaction cost). This represents a 46% saving per interaction.

So having looked at the evidence, it’s clear that digital comms have significant benefits when compared to post and calls. But what is THE most effective way to digitally chase missed payments?

Introducing Mobile Payments

Mobile Payments from Esendex are an innovative new way to approach collecting payments from customers. Mobile Payments target customer’s mobile devices to deliver a personalised, simple to use, fully-branded, payment environment.

Our solution is fully PCI compliant, which provides customers and businesses with the peace of mind that payments are being made in the most secure way possible. Identity validation can also be integrated into each payment to make sure that the correct customer is completing the payment.

The platform also provides all of the convenience of a completely self-serve platform, meaning that customers can make a payment at any time or place.

Who can use Mobile Payments?

The Mobile Payments platform can be used by just about any business that need to accept payments from their customers. Here are just some of the ways that our customers have been using the platform:

Financial sector

|

Local Government

|

|

|

Retail

|

Utilities

|

|

|

![Mobile Payments conversion rate]() Do Mobile Payments work?

Do Mobile Payments work?

Absolutely! Mobile Payments are proven to increase payments when compared to traditional forms of payment collections.

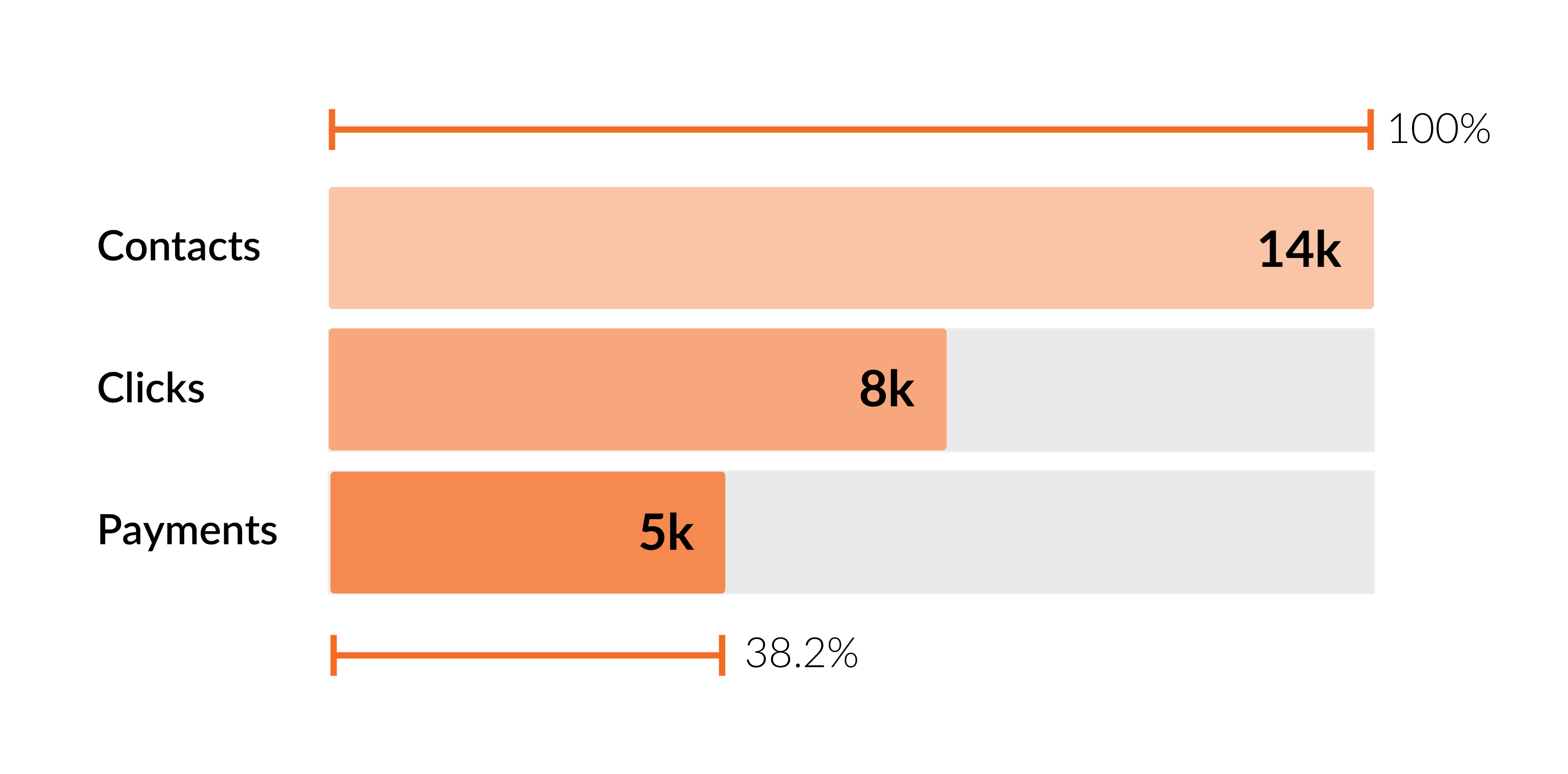

In a recent study by us, we took a sample group of 14,000 customers and found that just over 5,000 (38.2%) of them went on to make a payment.

What are the next steps?

If you’d like to see for yourself how Mobile Payments work, take a few moments to visit our Mobile Payments page, where you can take a demo and try one out on your mobile device right now.

We’ve worked with a variety of different businesses to provide more engaging ways for businesses to collect payments and save costs in the process. To find out how we could do the same for your business with a Mobile Payments solution, please get in contact with our team today by calling 0345 356 5758 or emailing [email protected]